It’s not just paper. From the first notes issued by the Continental Congress to the latest star-spangled bills released by the Federal Reserve, the history of money in America is laced with rebellion, propaganda, and—of course—lots and lots of wealth. It’s awkwardly beautiful.

The history of paper currency, specifically, serves as a curious lens through which to understand the origins of this complicated nation. Like the government itself, money in America dates back to 1776 when the Continental Congress issued the country’s first official dollar bills. But before and well after that, it had been a free-for-all with any bank or state able to issue its own currency. It wasn’t until the 20th century that the nation’s currency would be standardized and even recognizable to present-day observers.

1$, 1770

The first money went into circulation since the middle of the 18th century. They were used in North America in all the colonies, which at that time numbered 13. Depending on the location of the location, they were called either a dollar or a shilling. The banknotes were constantly forged, so the government was constantly improving their protection. For this and printing on banknotes of complex patterns, real leaves were also used. Also, for the forgery of bills, execution was determined.

50$, 1779

At the end of the US War of Independence, the Continental Congress issued the first national currency, the American dollar. The design of continental dollars was not much different from colonial banknotes. But it was on them appeared an unfinished pyramid, which you can contemplate on the back of the dollar bill. Issue of banknotes totaled 240 million dollars, which subsequently caused a monstrous inflation, which by 1781 led to its depreciation.

5$, 19th Century

Some stability was restored only after the signing of the Coin Act in 1792. A clear and logical monetary system was established, including both gold ten-dollar and copper half-cent coins, which were minted at the state mint. But the printing of banknotes was not so smoothly, because in their value depended on the financial condition of the institutions with which they were printed. So for a denomination of 5 dollars, issued by the Agricultural Bank of Tennessee gave only $ 4. Soon such a position used fraudsters, proceeding to issue counterfeit banknotes through one-day banks.

10$, 1862 (Confederation)

The next period in the development of paper bills was the Civil War. To maintain soldiers, the seal was produced in enormous sizes. The departed states began issuing their own currencies, which have no security. In those days, the dollar has already begun to create a distinctive design - simple, but at the same time having an ornamented border and two-color printing.

10$, 1862 (Union)

In 1862, a law was signed to start issuing notes for $ 50 million, which were provided with government securities. But their existence did not last long. The following year they were withdrawn from circulation.

10$, Greenback

At the end of the war, the country’s financial system entered a new level, which is called the golden age of design of banknotes. In addition to the greenbacks, the issue of silver certificates was launched. Silver certificates, in turn, could be exchanged for coins and ingots of silver.

Bills With Martha Washington, 1886

The year 1886 was remembered by the first design of a banknote depicting a real woman of the “first lady of the country” - Martha Washington.

Silver Certificate, 1892

In 1892, the Treasury issued an educational series. The issue was held in honor of the World Exhibition and was considered the most beautiful in the history of the development of US notes. On a one-dollar bill, they portrayed Colombia pointing to Washington’s monument. The design of this banknote traces a huge number of complex elements, thanks to which this series and became famous.

Silver Certificate, 1896

This is the aforementioned back featuring both George and Martha Washington. Check out the angels darting out of the corners!

Silver Certificate of 5 Dollars, 1896

On the denomination of $5, the bankers depict an allegorical scene “Electricity Presenting Light to the World,” thereby indicating America’s leadership in technological innovation.

Silver Certificate of 5 Dollars, 1899

It was thanks to the silver certificates that the borders of the banknotes and the sizes of the portraits appeared, that is, the foundation was laid, in addition to the silver certificates, gold was also issued, giving the right to the gold deposited in banks, sometimes reaching amounts of 10 thousand dollars. The turnover was until 1933, until the announcement of the ban by President Roosevelt on the accumulation of gold from private individuals.

Gold Certificate With a Face Value of 500 Dollars, 1865

The federal government started issuing Gold Certificates a few years before Silver Certificates, though they weren’t quite as widespread. The earliest series in 1865 came only in high denominations and looked a bit like the Legal Tender notes introduced around the same time. You could call them “goldbacks.”

George Washington on the $20 Gold Certificate, 1905

In the early years of the 20th century, a new and rather familiar design appeared. Using a three-ink printing process, the Gold Certificates were wonderfully vivid, so much so that the 1905 Series is commonly known as the “Technicolor Series.”

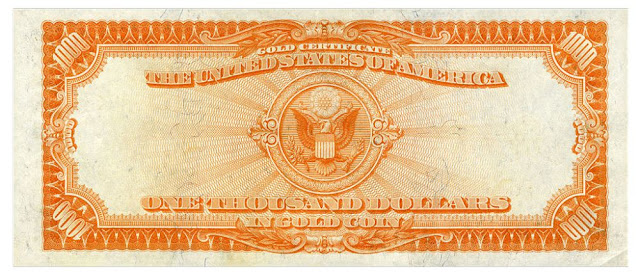

The Back of a $1,000 Gold Certificate

Alexander Hamilton was on the front.

The federal government continued to print Gold Certificates in denominations as high as $100,000 until 1934. The last of them look very similar to the standardized currency design, although some still had that sick bright gold back.

100$, 1914

Everything changed once again when Congress passed the Federal Reserve Act of 1913. This set up a system whereby Federal Reserve Notes were distributed to various Federal Reserve Banks around the country. The banknotes are legal tender backed by Fed, though Gold and Silver Certificates continued to be produced for quite some time. However, it was the new Fed system that brought us the timeless American money design that survived most of the 20th century.

At first, the notes remained as large as earlier banknotes. The front featured dead presidents, black and red or blue ink printed on a very special paper from Crane & Co.

5$, 1914

Many of the images on the back portrayed famous moments in American history or more generic depictions of American industry and values. This $5 Federal Reserve Note from 1914 shows the struggles of early settlers.

10,000$, 1934

While it’s unusual not to see a president on more modern money, Samon Chase was an exceptional player in the history of American money. He was Secretary of the Treasury under Abraham Lincoln and introduced the nation’s first paper money and national bank. The federal government last issued the $10,000, $5,000, $1,000, and $500 in 1934. Today, the largest bill in circulation is the $100, some say to make drug trafficking and money laundering more difficult.

100$, 1996

This brings us to the ambitious redesign of 1996. In an effort to improve anti-counterfeiting measures, the federal government redesigned five of the six remaining denominations of Federal Reserve Notes: $5, $10, $20, $50, and $100. The presidents’ heads got bigger and were moved off center. Much—but not all—of the beautiful engraving and scrollwork on the borders went away. New methods of thwarting counterfeiters, like color changing ink, also appeared on some of the bills. Still, it didn’t take long for a clever Chicago man to crack it and start printing virtually identical counterfeit $100 bills in his basement.

(via Gizmodo)

The history of paper currency, specifically, serves as a curious lens through which to understand the origins of this complicated nation. Like the government itself, money in America dates back to 1776 when the Continental Congress issued the country’s first official dollar bills. But before and well after that, it had been a free-for-all with any bank or state able to issue its own currency. It wasn’t until the 20th century that the nation’s currency would be standardized and even recognizable to present-day observers.

1$, 1770

The first money went into circulation since the middle of the 18th century. They were used in North America in all the colonies, which at that time numbered 13. Depending on the location of the location, they were called either a dollar or a shilling. The banknotes were constantly forged, so the government was constantly improving their protection. For this and printing on banknotes of complex patterns, real leaves were also used. Also, for the forgery of bills, execution was determined.

50$, 1779

At the end of the US War of Independence, the Continental Congress issued the first national currency, the American dollar. The design of continental dollars was not much different from colonial banknotes. But it was on them appeared an unfinished pyramid, which you can contemplate on the back of the dollar bill. Issue of banknotes totaled 240 million dollars, which subsequently caused a monstrous inflation, which by 1781 led to its depreciation.

5$, 19th Century

Some stability was restored only after the signing of the Coin Act in 1792. A clear and logical monetary system was established, including both gold ten-dollar and copper half-cent coins, which were minted at the state mint. But the printing of banknotes was not so smoothly, because in their value depended on the financial condition of the institutions with which they were printed. So for a denomination of 5 dollars, issued by the Agricultural Bank of Tennessee gave only $ 4. Soon such a position used fraudsters, proceeding to issue counterfeit banknotes through one-day banks.

10$, 1862 (Confederation)

The next period in the development of paper bills was the Civil War. To maintain soldiers, the seal was produced in enormous sizes. The departed states began issuing their own currencies, which have no security. In those days, the dollar has already begun to create a distinctive design - simple, but at the same time having an ornamented border and two-color printing.

10$, 1862 (Union)

In 1862, a law was signed to start issuing notes for $ 50 million, which were provided with government securities. But their existence did not last long. The following year they were withdrawn from circulation.

10$, Greenback

At the end of the war, the country’s financial system entered a new level, which is called the golden age of design of banknotes. In addition to the greenbacks, the issue of silver certificates was launched. Silver certificates, in turn, could be exchanged for coins and ingots of silver.

Bills With Martha Washington, 1886

The year 1886 was remembered by the first design of a banknote depicting a real woman of the “first lady of the country” - Martha Washington.

Silver Certificate, 1892

In 1892, the Treasury issued an educational series. The issue was held in honor of the World Exhibition and was considered the most beautiful in the history of the development of US notes. On a one-dollar bill, they portrayed Colombia pointing to Washington’s monument. The design of this banknote traces a huge number of complex elements, thanks to which this series and became famous.

Silver Certificate, 1896

This is the aforementioned back featuring both George and Martha Washington. Check out the angels darting out of the corners!

Silver Certificate of 5 Dollars, 1896

On the denomination of $5, the bankers depict an allegorical scene “Electricity Presenting Light to the World,” thereby indicating America’s leadership in technological innovation.

Silver Certificate of 5 Dollars, 1899

It was thanks to the silver certificates that the borders of the banknotes and the sizes of the portraits appeared, that is, the foundation was laid, in addition to the silver certificates, gold was also issued, giving the right to the gold deposited in banks, sometimes reaching amounts of 10 thousand dollars. The turnover was until 1933, until the announcement of the ban by President Roosevelt on the accumulation of gold from private individuals.

Gold Certificate With a Face Value of 500 Dollars, 1865

The federal government started issuing Gold Certificates a few years before Silver Certificates, though they weren’t quite as widespread. The earliest series in 1865 came only in high denominations and looked a bit like the Legal Tender notes introduced around the same time. You could call them “goldbacks.”

George Washington on the $20 Gold Certificate, 1905

In the early years of the 20th century, a new and rather familiar design appeared. Using a three-ink printing process, the Gold Certificates were wonderfully vivid, so much so that the 1905 Series is commonly known as the “Technicolor Series.”

The Back of a $1,000 Gold Certificate

Alexander Hamilton was on the front.

The federal government continued to print Gold Certificates in denominations as high as $100,000 until 1934. The last of them look very similar to the standardized currency design, although some still had that sick bright gold back.

100$, 1914

Everything changed once again when Congress passed the Federal Reserve Act of 1913. This set up a system whereby Federal Reserve Notes were distributed to various Federal Reserve Banks around the country. The banknotes are legal tender backed by Fed, though Gold and Silver Certificates continued to be produced for quite some time. However, it was the new Fed system that brought us the timeless American money design that survived most of the 20th century.

At first, the notes remained as large as earlier banknotes. The front featured dead presidents, black and red or blue ink printed on a very special paper from Crane & Co.

5$, 1914

Many of the images on the back portrayed famous moments in American history or more generic depictions of American industry and values. This $5 Federal Reserve Note from 1914 shows the struggles of early settlers.

10,000$, 1934

While it’s unusual not to see a president on more modern money, Samon Chase was an exceptional player in the history of American money. He was Secretary of the Treasury under Abraham Lincoln and introduced the nation’s first paper money and national bank. The federal government last issued the $10,000, $5,000, $1,000, and $500 in 1934. Today, the largest bill in circulation is the $100, some say to make drug trafficking and money laundering more difficult.

100$, 1996

This brings us to the ambitious redesign of 1996. In an effort to improve anti-counterfeiting measures, the federal government redesigned five of the six remaining denominations of Federal Reserve Notes: $5, $10, $20, $50, and $100. The presidents’ heads got bigger and were moved off center. Much—but not all—of the beautiful engraving and scrollwork on the borders went away. New methods of thwarting counterfeiters, like color changing ink, also appeared on some of the bills. Still, it didn’t take long for a clever Chicago man to crack it and start printing virtually identical counterfeit $100 bills in his basement.

(via Gizmodo)